HYIP portfolio - strategies for diversifying your portfolio, a guide

High-Yield Investment Programs (HYIPs) can be a lucrative yet risky venture, and successful investors understand the importance of diversification in managing these risks.

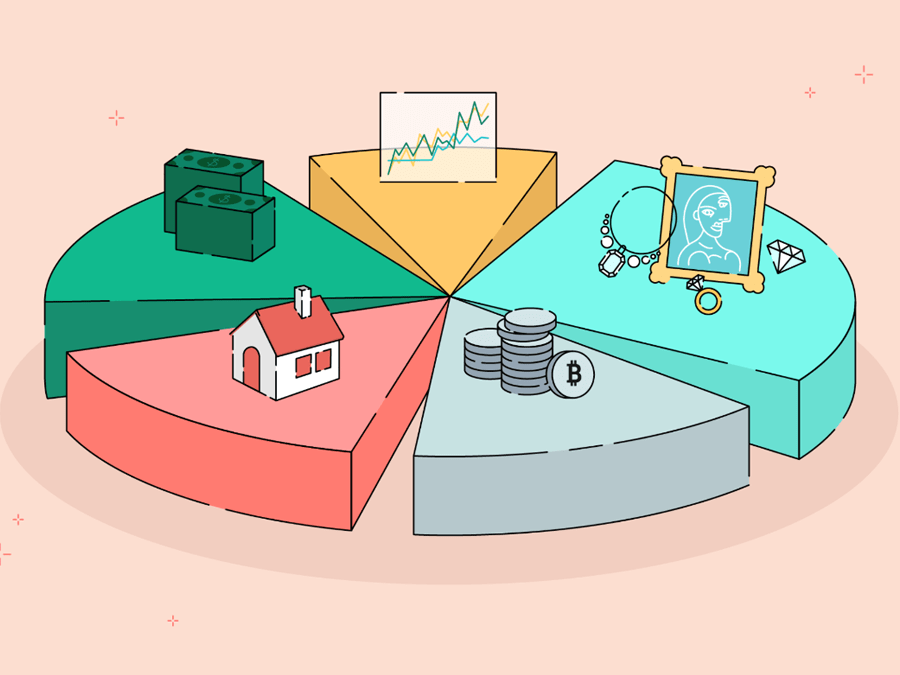

High-Yield Investment Programs (HYIPs) can be a lucrative yet risky venture, and successful investors understand the importance of diversification in managing these risks.Diversifying your HYIP portfolio involves spreading your investments across different programs to minimize the impact of potential losses.

In this information-style article, we will explore strategies for effectively diversifying your HYIP portfolio and include interesting facts to enhance your understanding.

Strategies for diversifying your HYIP portfolio: a comprehensive guide

🔹 1. Understand the Basics of Diversification:

Diversification is a fundamental principle in investment management. By allocating funds across various HYIPs, you can reduce the impact of a single program's failure on your overall portfolio. This strategy can help you achieve a more balanced risk-return profile.

Interesting Fact: Historically, renowned investors like Warren Buffett and Ray Dalio have emphasized the importance of diversification in their investment philosophies, highlighting its effectiveness in managing risk.

🔹 2. Explore Different HYIP Categories:

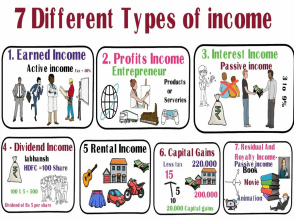

HYIPs come in various forms, including cryptocurrency investments, forex trading, real estate ventures, and more. Diversify your portfolio by investing in different categories to spread risk and capitalize on diverse market opportunities.

Interesting Fact: The first recorded HYIP dates back to the 1920s, where investors were promised extraordinary returns from oil and gas ventures. This historical perspective highlights the enduring appeal of high-yield opportunities.

🔹 3. Evaluate Program Lifespan and Sustainability:

Assess the longevity and sustainability of HYIPs before investing. Programs with a proven track record and transparent business models are generally more reliable. Avoid putting all your funds into recently launched programs, as they carry a higher risk of failure.

Interesting Fact:* Some long-standing HYIPs have been known to operate successfully for several years, attracting a loyal investor base. Investigating the history of a program can provide valuable insights into its credibility.

🔹 4. Monitor Program Reputation and Reviews:

Research the reputation of HYIPs by reading reviews and forums. Online communities often share experiences and warnings about specific programs. Diversify your investments by choosing programs with positive feedback and a strong online presence.

Interesting Fact: The rise of social media has significantly impacted the HYIP landscape, with investors sharing information and opinions on platforms like Reddit and Bitcointalk. Staying informed about community sentiment is crucial for successful diversification.

🔹 5. Allocate Funds Strategically:

Once you've selected a diversified set of HYIPs, allocate your funds strategically. Avoid overconcentration in any single program to maintain a balanced portfolio. Consider factors such as potential returns, risk tolerance, and overall investment goals when distributing your funds.

Interesting Fact: Modern portfolio theory, developed by Nobel laureate Harry Markowitz, emphasizes the importance of asset allocation in achieving optimal returns with minimal risk. This principle is applicable to the diversification of HYIP portfolios as well.

🔹 6. Regularly Review and Rebalance:

Market conditions and the performance of HYIPs can change over time. Regularly review your portfolio and rebalance your investments to ensure they align with your risk tolerance and financial goals. This proactive approach can help you stay ahead of potential risks.

Interesting Fact: The concept of portfolio rebalancing is akin to pruning a garden to encourage healthy growth. Just as a garden requires regular attention, your HYIP portfolio benefits from periodic adjustments to maintain its health and sustainability.

🔹 7. Stay Informed About Industry Trends:

Keep yourself informed about industry trends, regulatory changes, and global economic factors that may impact your HYIP investments. Understanding the broader context can help you make more informed decisions and adjust your portfolio accordingly.

Interesting Fact: The HYIP industry is closely tied to global economic conditions and technological advancements. For example, the rise of blockchain technology has given birth to HYIPs in the form of decentralized finance (DeFi), adding a new dimension to investment opportunities.

🔹 8. Diversify Across Investment Vehicles:

Consider diversifying not only within HYIPs but also across different investment vehicles. Combining traditional investments with high-yield opportunities can create a well-rounded portfolio that balances risk and return.

Interesting Fact: Notable investors often diversify across asset classes, including stocks, bonds, real estate, and alternative investments. This strategy, known as diversification across different asset classes, aims to reduce the impact of poor performance in any single sector.

🔹 9. Set Realistic Expectations:

While high-yield investments offer the potential for significant returns, it's crucial to set realistic expectations. Avoid the allure of programs promising unrealistic gains, as they often come with higher risks. Prudent investors focus on sustainable returns over time.

Interesting Fact: The allure of high returns has sometimes led investors to fall victim to Ponzi schemes. The term "Ponzi scheme" originated from Charles Ponzi, who became infamous for orchestrating one of the most well-known investment scams in the early 20th century.

🔹 10. Diversify Beyond Monetary Investments:

Consider diversifying your investments beyond monetary instruments. Some HYIPs offer unique opportunities, such as tokenized real estate, green energy projects, or innovative tech startups. Exploring these non-traditional avenues can add an exciting dimension to your portfolio.

Interesting Fact: The advent of tokenization has allowed investors to participate in fractional ownership of high-value assets, making previously inaccessible investments more widely available to a broader audience.

Summary

Diversifying your HYIP portfolio is not only a risk management strategy but also an art that requires continual adaptation and informed decision-making. By implementing these strategies and staying attuned to market trends, you can navigate the complex landscape of high-yield investments with greater confidence.

Remember, a well-diversified portfolio is like a resilient ship that can weather the storms of market volatility, ultimately steering you toward your financial goals.

Other News

Add a review

Unraveling the Nexus - Symbiosis between Markets + Cryptocurrency

Unraveling the Nexus - Symbiosis between Markets + Cryptocurrency The rise of robo-advisors - how auto investing is changing the game

The rise of robo-advisors - how auto investing is changing the game How to assess the credibility - and track record of a HYIP program

How to assess the credibility - and track record of a HYIP program Realistic goals - setting realistic goals for online investments

Realistic goals - setting realistic goals for online investments Withdrawal Process - unveiling the withdrawal process in HYIP monitor

Withdrawal Process - unveiling the withdrawal process in HYIP monitor