The rise of robo-advisors - how auto investing is changing the game

In recent years, the financial landscape has witnessed a significant transformation with the emergence and widespread adoption of robo-advisors.

In recent years, the financial landscape has witnessed a significant transformation with the emergence and widespread adoption of robo-advisors. These automated investment platforms are revolutionizing the way individuals manage their finances, offering a seamless and cost-effective alternative to traditional investment methods.

As an expert in cryptocurrency, I will delve into the impact of robo-advisors on the investment industry and explore their role in the ever-evolving financial ecosystem.

The rise of robo-advisors: how automated investing is changing the game

1. What are Robo-Advisors?

Robo-advisors are automated investment platforms that leverage algorithms and artificial intelligence to provide financial advice and manage investment portfolios. These digital advisors analyze an individual's financial situation, risk tolerance, and investment goals to create a diversified portfolio tailored to their specific needs.

The rise of robo-advisors has democratized access to professional investment advice, allowing even those with limited financial knowledge to participate in the market.

2. Cost-Effectiveness and Accessibility

One of the key advantages of robo-advisors is their cost-effectiveness. Traditional financial advisors often charge hefty fees, making personalized investment advice a luxury for many. Robo-advisors, on the other hand, typically have lower fees, making them an attractive option for cost-conscious investors.

Additionally, the minimum investment requirements are often more accessible, allowing individuals with smaller portfolios to benefit from professional asset management.

3. Customization and Personalization

Robo-advisors excel in customization, tailoring investment portfolios based on an individual's risk tolerance, time horizon, and financial goals. The algorithms behind these platforms continuously analyze market trends and adjust portfolios accordingly. This level of personalization ensures that investors' portfolios remain aligned with their evolving financial situations and objectives.

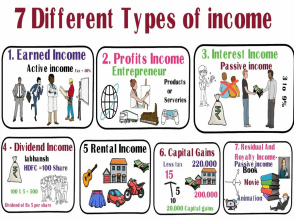

4. Integration of Cryptocurrencies

As an expert in cryptocurrency, it's crucial to note that some robo-advisors have integrated digital assets into their investment offerings. This development reflects the growing acceptance of cryptocurrencies as legitimate investment options.

Investors can now diversify their portfolios by including cryptocurrencies alongside traditional assets like stocks and bonds. The inclusion of cryptocurrencies introduces a new dimension of potential returns and risk management.

5. Robo-Advisors and Market Volatility

Robo-advisors have demonstrated resilience during times of market volatility. Their algorithms are designed to react swiftly to changing market conditions, automatically rebalancing portfolios to mitigate risks.

This proactive approach can be particularly beneficial in turbulent times, providing investors with a level of reassurance and risk management that might be challenging to achieve with traditional investment methods.

6. The Future of Automated Investing

The rise of robo-advisors marks a paradigm shift in the investment landscape, challenging the dominance of traditional financial advisory services. As technology continues to advance, we can expect further innovations in the robo-advisory space.

The integration of artificial intelligence, machine learning, and blockchain technology may open new avenues for even more sophisticated and efficient automated investment strategies.

7. The Role of Cryptocurrencies in Robo-Advisors

As we delve deeper into the integration of cryptocurrencies into robo-advisory platforms, it's essential to understand the impact of digital assets on portfolio diversification. Cryptocurrencies, such as Bitcoin and Ethereum, have emerged as alternative investment options with unique characteristics.

Unlike traditional assets, cryptocurrencies operate on decentralized blockchain technology, offering potential benefits such as transparency, security, and 24/7 market availability.

Robo-advisors incorporating cryptocurrencies allow investors to access this burgeoning asset class without the complexities of managing digital wallets or understanding blockchain technology.

The algorithms driving these platforms analyze the risk-return profiles of various cryptocurrencies, strategically incorporating them into portfolios to enhance diversification. This integration can be particularly appealing to investors seeking to capitalize on the potential high returns associated with cryptocurrencies while managing overall portfolio risk.

8. Regulatory Landscape and Security Concerns

As the popularity of robo-advisors continues to grow, regulators are closely monitoring the industry to ensure investor protection. It is crucial for investors to choose robo-advisory platforms that comply with relevant financial regulations. Additionally, the integration of cryptocurrencies introduces an additional layer of complexity, as the regulatory landscape for digital assets is still evolving.

Security concerns also play a significant role, especially in the context of cryptocurrencies. While blockchain technology provides a secure and transparent transaction environment, the risk of hacking and unauthorized access remains.

Investors should prioritize platforms with robust security measures, such as encryption protocols and secure storage solutions, to safeguard their digital assets.

9. Educational Initiatives and Financial Literacy

The rise of robo-advisors brings forth a new era in financial services, emphasizing the importance of financial literacy. Many individuals, particularly those new to investing, may find the algorithms and technicalities of robo-advisors intimidating. As an expert in cryptocurrency and finance, I encourage the development of educational initiatives to empower investors with the knowledge needed to make informed decisions.

Educational resources provided by robo-advisors can bridge the knowledge gap, helping investors understand the intricacies of algorithmic investing and the role of cryptocurrencies in their portfolios. Increasing financial literacy is not only beneficial for individual investors but also contributes to the overall resilience and stability of the financial system.

10. The Global Reach of Robo-Advisors

The adoption of robo-advisors is not limited to a specific region or demographic. These platforms have gained popularity globally, offering investment opportunities to a diverse range of investors.

From tech-savvy millennials to seasoned investors looking for automated solutions, robo-advisors cater to a broad audience. The global reach of these platforms contributes to the democratization of investment, breaking down geographical barriers and providing financial services to individuals worldwide.

In conclusion, the rise of robo-advisors, coupled with the integration of cryptocurrencies, represents a dynamic shift in the investment landscape. As an expert in cryptocurrency, I foresee continued growth and innovation in this space.

Investors should stay informed, embrace educational opportunities, and carefully evaluate robo-advisory platforms to harness the full potential of automated investing in this ever-evolving financial landscape.

Other News

Add a review

Unraveling the Nexus - Symbiosis between Markets + Cryptocurrency

Unraveling the Nexus - Symbiosis between Markets + Cryptocurrency The rise of robo-advisors - how auto investing is changing the game

The rise of robo-advisors - how auto investing is changing the game How to assess the credibility - and track record of a HYIP program

How to assess the credibility - and track record of a HYIP program Realistic goals - setting realistic goals for online investments

Realistic goals - setting realistic goals for online investments Withdrawal Process - unveiling the withdrawal process in HYIP monitor

Withdrawal Process - unveiling the withdrawal process in HYIP monitor