Basics of online investing - understanding and a guide for beginners

Welcome to the exciting world of online investing! If you're new to the game and feeling a bit overwhelmed, fret not – this guide is designed just for you.

Welcome to the exciting world of online investing! If you're new to the game and feeling a bit overwhelmed, fret not – this guide is designed just for you. Investing online can be a rewarding journey, but it's crucial to grasp the fundamentals before diving in.

In this friendly and informative article, we'll break down the basics of online investing, helping you embark on your investment journey with confidence.

Understanding the basics of online investing: a guide for beginners

🔹1. Setting the Stage: What is Online Investing?

Online investing involves using digital platforms to buy and sell financial instruments such as stocks, bonds, and funds. Unlike traditional methods, online investing provides the convenience of executing trades from the comfort of your home or on the go.

🔹2. Choosing Your Path: Types of Investments

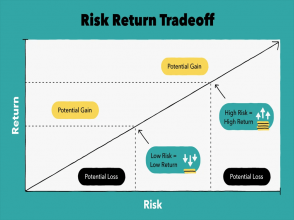

Before taking the plunge, it's essential to understand the various types of investments available. Stocks, bonds, mutual funds, and exchange-traded funds (ETFs) are common choices for beginners. Each comes with its own risk and return profile, so it's wise to diversify your portfolio for a balanced approach.

🔹3. Building Your Arsenal: Opening an Online Brokerage Account

To start investing online, you'll need to open an account with an online brokerage. Choose a platform that suits your needs, offers educational resources, and provides a user-friendly interface. Most platforms have step-by-step guides to assist beginners in setting up their accounts.

🔹4. Decoding the Jargon: Understanding Key Terms

The world of investing has its own set of jargon that might seem confusing at first. Get acquainted with terms like "bull market," "bear market," "dividends," and "portfolio diversification." A solid understanding of these terms will empower you to make informed decisions.

🔹5. Mastering the Art of Research: Due Diligence Matters

Successful investing involves thorough research. Before making any investment decisions, dig into the financial health of the companies or funds you're interested in. Analyze historical performance, read expert opinions, and stay updated on market trends.

🔹6. Risk Management: The Heart of Investing

Every investment carries some level of risk. It's crucial to assess your risk tolerance and set realistic expectations. Diversifying your investments across different assets can help mitigate risks and protect your portfolio during market fluctuations.

🔹7. Staying Informed: The Importance of Continuous Learning

The world of finance is dynamic, and staying informed is key to making sound investment decisions. Follow financial news, read market analyses, and consider joining online investment communities to learn from experienced investors and share insights.

🔹8. Patience and Discipline: Keys to Long-Term Success

Investing is a long-term game, and patience is a virtue. Resist the urge to make impulsive decisions based on short-term market fluctuations. Stick to your investment plan, review and adjust it periodically, and let time work in your favor.

🔹9. Embracing Technology: Harnessing Tools for Success

Online investing is not just about trading stocks; it's also about leveraging technology to your advantage. Explore the tools and resources offered by your online brokerage, such as real-time market data, investment calculators, and mobile apps. These tools can provide valuable insights and make your investment journey more efficient.

🔹10. Tax Implications: Understanding the Basics

While the goal of investing is to grow your wealth, it's essential to be aware of the tax implications. Different investments may have varying tax treatments, and it's crucial to understand how gains and losses are taxed. Consider consulting with a tax professional to ensure you optimize your investment strategy from a tax perspective.

🔹11. Dollar-Cost Averaging: A Smart Investment Strategy

For beginners, the concept of timing the market can be daunting. Instead of trying to predict market movements, consider adopting a strategy called dollar-cost averaging. This involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions. This approach helps reduce the impact of market volatility over time.

🔹12. Learning from Mistakes: It's Okay to Make Them

Investing is a journey of continuous learning, and everyone makes mistakes along the way. Instead of dwelling on errors, view them as opportunities to learn and refine your strategy. Reflect on your decisions, understand what went wrong, and use these experiences to become a more informed and resilient investor.

🔹13. Seeking Professional Advice: When to Consult an Expert

While there's a wealth of information available online, sometimes seeking advice from financial professionals can be invaluable. Whether it's a certified financial planner or an investment advisor, having a professional guide you through your investment journey can provide personalized insights based on your financial goals and risk tolerance.

🔹14. Monitoring Your Investments: Regular Check-Ins

Regularly review your investment portfolio to ensure it aligns with your financial goals. Market conditions, economic trends, and personal circumstances may change, so it's crucial to adapt your investment strategy accordingly. Periodic check-ins will also allow you to rebalance your portfolio if necessary.

🔹15. Celebrating Milestones: Acknowledge Your Progress

As you embark on your online investing journey, take the time to celebrate your achievements. Whether it's reaching a specific financial milestone or successfully navigating a challenging market period, acknowledging your progress can help boost your confidence and motivation.

Conclusion: your journey, your success

Congratulations on taking the first steps towards becoming an online investor!

By understanding the basics, conducting thorough research, and maintaining a disciplined approach, you're well on your way to building a successful investment portfolio.

Remember, the journey may have its ups and downs, but with knowledge and persistence, you can navigate the world of online investing with confidence and optimism. Happy investing!

Other News

Add a review

Unraveling the Nexus - Symbiosis between Markets + Cryptocurrency

Unraveling the Nexus - Symbiosis between Markets + Cryptocurrency The rise of robo-advisors - how auto investing is changing the game

The rise of robo-advisors - how auto investing is changing the game How to assess the credibility - and track record of a HYIP program

How to assess the credibility - and track record of a HYIP program Realistic goals - setting realistic goals for online investments

Realistic goals - setting realistic goals for online investments Withdrawal Process - unveiling the withdrawal process in HYIP monitor

Withdrawal Process - unveiling the withdrawal process in HYIP monitor