Potential of cryptocurrencies - unlocking opportunities in markets

Cryptocurrencies have undeniably transformed the financial landscape, introducing a decentralized and borderless approach to transactions.

Cryptocurrencies have undeniably transformed the financial landscape, introducing a decentralized and borderless approach to transactions. While their adoption has been notable in developed nations, the true potential of cryptocurrencies lies in their impact on emerging markets.

As an expert in cryptocurrency topics, let's delve into the myriad ways in which these digital assets can revolutionize financial systems in developing economies.

Unlocking opportunities: exploring the potential of cryptocurrencies in emerging markets

🤑 1. Financial Inclusion:

One of the most significant advantages of cryptocurrencies in emerging markets is their potential to promote financial inclusion. Traditional banking services often struggle to reach remote areas, leaving a substantial portion of the population without access to basic financial tools.

Cryptocurrencies, however, can be accessed with just a smartphone and an internet connection, offering a lifeline to the unbanked and underbanked populations.

🤑 2. Remittances Made Seamless:

Remittances play a crucial role in the economies of many emerging markets. Cryptocurrencies provide a faster and more cost-effective alternative to traditional remittance methods. With the ability to send funds across borders without the need for intermediaries, cryptocurrencies mitigate the high fees associated with traditional remittance services. This can be a game-changer for families relying on remittances for their livelihoods.

Interesting Fact: According to a World Bank report, the global average cost of sending remittances is around 6.8%. Cryptocurrencies have the potential to significantly reduce this cost, making cross-border transactions more accessible.

🤑 3. Hyperinflation Hedge:

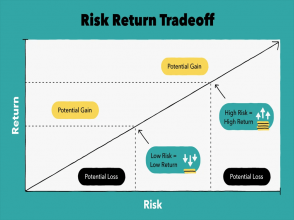

Cryptocurrencies can serve as a hedge against hyperinflation, a common challenge faced by several emerging market economies. With a finite supply and decentralized nature, certain cryptocurrencies like Bitcoin act as a store of value that can withstand the erosive effects of hyperinflation. In countries where fiat currencies are volatile, individuals can turn to cryptocurrencies to preserve their wealth.

🤑 4. Empowering Small Businesses:

Micro, small, and medium-sized enterprises (MSMEs) are the backbone of many emerging economies. However, these businesses often face challenges in accessing financial services.

Cryptocurrencies offer a decentralized financing model through Initial Coin Offerings (ICOs) or token sales, enabling small businesses to raise capital globally without the need for a traditional banking infrastructure.

Interesting Fact: In 2017, the ICO market raised over $6.2 billion globally, providing a new avenue for fundraising that was previously inaccessible to many small businesses.

🤑 5. Technology Adoption and Innovation:

Cryptocurrencies come with underlying blockchain technology, which offers transparency, security, and efficiency. The adoption of blockchain technology can enhance various sectors such as healthcare, supply chain, and government services in emerging markets. By embracing decentralized ledgers, these economies can streamline processes, reduce corruption, and improve overall efficiency.

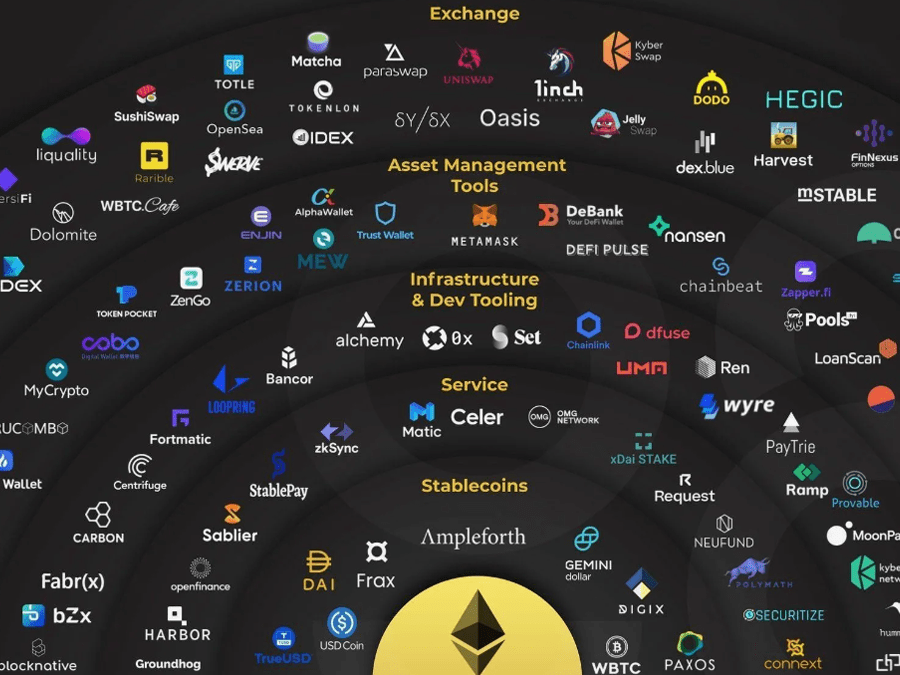

🤑 6. Decentralized Finance (DeFi):

Decentralized Finance, commonly known as DeFi, is a rapidly growing sector within the cryptocurrency space. DeFi platforms provide financial services without traditional intermediaries, offering savings, loans, and investment opportunities.

This decentralized approach can empower individuals who lack access to traditional banking systems, fostering financial independence.

Interesting Fact: The total value locked in DeFi protocols surpassed $100 billion in 2023, highlighting the growing significance of decentralized financial services.

🤑 7. Governmental Initiatives:

Some emerging market governments have recognized the potential of cryptocurrencies and blockchain technology, leading to the implementation of supportive policies.

By embracing these technologies, governments can enhance transparency, reduce corruption, and create more efficient systems for public services. Countries like Estonia have already integrated blockchain technology into aspects of governance, demonstrating the potential for positive change.

Interesting Fact: The Republic of Estonia is known for its pioneering efforts in e-governance, with its e-residency program and blockchain-based initiatives making it a notable example of government-led blockchain adoption.

🤑 8. Access to Global Markets:

Cryptocurrencies break down barriers, allowing individuals in emerging markets to participate in global markets. With just an internet connection, users can trade digital assets, access a wide range of financial products, and diversify their investment portfolios. This newfound access to global markets empowers individuals and businesses in emerging economies to take advantage of opportunities that were previously out of reach.

🤑 9. Tokenization of Assets:

Cryptocurrencies facilitate the tokenization of assets, converting physical or illiquid assets into digital tokens on a blockchain. This process can unlock liquidity in traditionally illiquid markets, such as real estate or art. In emerging markets where traditional financing for such assets may be limited, tokenization offers a novel and accessible way for individuals to invest in a diversified range of assets.

Interesting Fact: The global real estate tokenization market is projected to reach over $1.5 billion by 2025, reflecting the growing interest in using blockchain technology to make real estate more accessible to a broader audience.

🤑 10. Educational Opportunities:

Cryptocurrencies present unique educational opportunities for individuals in emerging markets. The decentralized nature of blockchain technology allows for peer-to-peer learning and skill development.

Online courses, webinars, and open-source resources provide a wealth of information, empowering individuals to gain expertise in blockchain technology and its various applications.

Potential of cryptocurrencies

As an expert in cryptocurrency topics, it is evident that the potential impact of cryptocurrencies on emerging markets is vast and multifaceted. From financial inclusion to technological innovation, these digital assets are reshaping the economic landscape of nations around the world. While challenges remain, the opportunities for positive change and progress are significant.

As more individuals, businesses, and governments in emerging markets recognize and harness the potential of cryptocurrencies, we are likely to witness a more inclusive, efficient, and decentralized global financial ecosystem. The journey towards unlocking this potential is an exciting and dynamic evolution in the world of finance.

Other News

Add a review

Unraveling the Nexus - Symbiosis between Markets + Cryptocurrency

Unraveling the Nexus - Symbiosis between Markets + Cryptocurrency The rise of robo-advisors - how auto investing is changing the game

The rise of robo-advisors - how auto investing is changing the game Realistic goals - setting realistic goals for online investments

Realistic goals - setting realistic goals for online investments Withdrawal Process - unveiling the withdrawal process in HYIP monitor

Withdrawal Process - unveiling the withdrawal process in HYIP monitor